texas estate tax exemption

The most common reason is to avoid Texas probate. The property must have had an ag exemption in the previous tax year and must be at least 10 acres.

Form Ap 209 Download Fillable Pdf Or Fill Online Texas Application For Exemption Religious Organizations Texas Templateroller

Temporary Disaster Exemption Texas weather event 2022.

. Texas does not have a state estate tax or inheritance tax. For those who qualify for the over 65 exemption there is something called the property tax ceiling. The gift tax exemption for 2021 is 15000 per year per recipient increasing to 16000 in 2022.

Department of Veterans Affairs due to a 100 percent disability rating or determination of individual unemployability by the US. As per this exemption the taxing units have the option to offer an extra homestead exemption of at least 3000 for those aged 65 or older. Property tax rates in Texas are recalculated each year after appraisers have evaluated all the property in the county.

The Hazlewood Act is a State of Texas benefit that provides qualified Veterans spouses and dependent children with an education benefit of up to 150 hours of tuition exemption including most fee charges at public institutions of higher education in TexasThis does NOT include living expenses books or supply fees. Freeman has been recognized by US. Effective January 1 2022 a Texas property tax exemption change will benefit new property owners by allowing the homestead exemption for a partial year.

We offer Texas Protax property tax consulting services for businesses and homeowners alike. Tax Code Section 11131 requires an exemption of the total appraised value of homesteads of Texas veterans who received 100 percent compensation from the US. 2 the term also includes the use of land to raise or keep bees for pollination for the production of human food or other.

There are many reasons for transferring Texas real estate into a living trust or other revocable or irrevocable trust. Tax rates and ultimately the amount of taxes levied on property are. Federal Tax or IRS Liens A federal tax lien is the US.

Property transferred to a valid living trust can continue to qualify. The exemption continued to increase annually until it matched the federal estate tax exemption in 2019. The details can be found in the Texas Property Tax Code under chapter 23 Subchapter D Sec.

However Texas residents still must adhere to federal estate tax guidelines. Department of Veterans Affairs. If the tax has already been paid the excess amount will be refunded.

Meaning the only gift tax you have to worry about is the federal gift tax. What Does the Law Say About Property Tax and Bees. The change from 2012 allowing beekeeping is in the last sentence of paragraph 2.

Groceries prescription drugs and non-prescription drugs are exempt from the Texas sales tax. Election day is Saturday May 7 2022 so make sure you vote. Governments legal claim against your property when you dont pay a tax debt.

During a state sales tax audit the company and the state agree to a sample period in order to test if sales tax was properly calculated on the revenue of the company. Child Support Liens Under Texas law its possible to obtain a lien for unpaid child support. Counties and cities can charge an additional local sales tax of up to 2 for a maximum possible combined sales tax of 825.

The law covering agricultural use related to beekeeping is Texas Tax Code under Chapter 23 Subchapter D Section 2352 1 and 2. The previous requirements for eligibility to receive the homestead exemption still apply. Blake Bennett Extension Economist Dallas Ag Exemption o Common term used to explain the Central Appraisal Districts CAD appraised value of the land o Is not an exemption Is a special use appraisal based on the productivity value of the land not market value.

The sample period can be one month quarter or year. Vicente Gonzalez of Texas and his wife skirted around. A vulnerable House Democrat in Texas double dipped on a property tax exemption for at least eight years.

Some of the important requirements include. We would like to show you a description here but the site wont allow us. Nonprofit organizations with an exemption from Internal Revenue Service IRS under IRC Section 501c 3 4 8 10 or 19.

TEXAS PARKS WILDLIFE. The state will request all the sales support for that period including sales tax exemption certificates. PROPERTY TAX EXEMPTIONS.

The decedent died without a will. The vast majority of voters also approved Proposition 2 to raise the states homestead exemption the dollar amount of a homes value thats exempt from taxation by school districts. The Texas state sales tax rate is 625 and the average TX sales tax after local surtaxes is 805.

Property Tax Liens This is a legal claim against a property for unpaid property taxes. Transferring Texas real estate to a living trust removes the real estate from the transferors probate estate and bypasses the Texas probate process. From 2014 to 2021 Democrat Rep.

Persons who are at least 65 or who are disabled can claim an additional exemption of 10000. Appraisal values for the county of Ward Welcome to the website of the Ward County Tax Assessor - Collector. The Texas Tax Code provides an exemption from franchise tax and sales tax to.

Texas Ag Exemption What is it and What You Should Know Dr. Texas Property Tax Rates. Chambers.

Construct and maintain the property in or of a residential condominium or residential real estate development that is legally. And 4 meet the requirements of a charitable organization provided by Sections 1118e and f for which purpose the functions for which the association is organized are considered to be charitable functions. Benefits of qualifying for an over 65 property tax exemption.

I Community Service Clubs. If the new owner qualifies to receive the exemption prior to January 1 of the following year the taxing units will recalculate the amount of tax due and correct the tax roll. Like the homestead exemption only school districts are required to offer this exemption.

This exemption will increase by 15000 to a 40000 school district exemption for the 2022 tax year with voter approval. News and World Reports Best Lawyers in America list. Small Estate Affidavits called SEA for short can be an affordable way to transfer property to a decedents heirs.

And named the Leading Tax Controversy Litigation Attorney of the Year for the State of Texas 2019 and 2020 by AI. Jeff is a licensed real estate agent and his professional associations include the. Official site of the Ward County Tax Assessor - Collector.

Oregon Oregons estate tax rates changed on January 1 2012 so that estates valued between 1 million and 2 million would pay slightly less in estate taxes and estates valued over 2 million would pay more. 3 qualify for an exemption from the franchise tax under Section 171060. Texas has 2176 special sales tax jurisdictions with local.

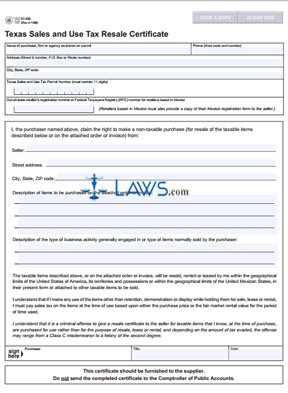

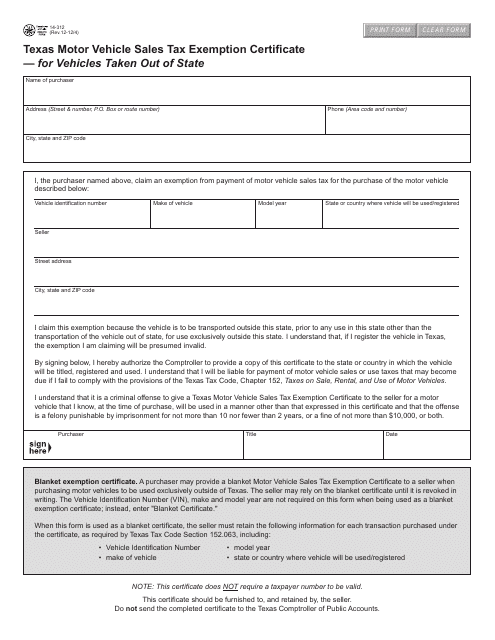

TEXAS SALES AND USE TAX RESALE CERTIFICATE AND CERTIFICATION Form 01-339 If you are a Texas business owner purchasing items from an out-of-state retailer for the purposes of reselling leasing or otherwise profiting from this purchase you may claim an exemption on the use tax that would have to be paid if you were making this acquisition for. You may be able to use an SEA to probate an estate in Texas if you meet all of the requirements set out in the Texas Estates Code Chapter 205.

Free Form 01 339 Texas Sales And Use Tax Exemption Certification Free Legal Forms Laws Com

Texas Estate Tax Everything You Need To Know Smartasset

If You Purchased A Home Last Year And It Is Your Primary Residence You May Be Entitled To A Homestead Real Estate Tax Exem New Homeowner Real Estate Estate Tax

Texas Estate Tax Everything You Need To Know Smartasset

/https://static.texastribune.org/media/images/2017/08/12/UP9A0022.JPG)

Property Tax Relief Available To Texas Homeowners Through Homestead Exemptions The Texas Tribune

State Corporate Income Tax Rates And Brackets Tax Foundation

Form 14 312 Download Fillable Pdf Or Fill Online Texas Motor Vehicle Sales Tax Exemption Certificate For Vehicles Taken Out Of State Texas Templateroller

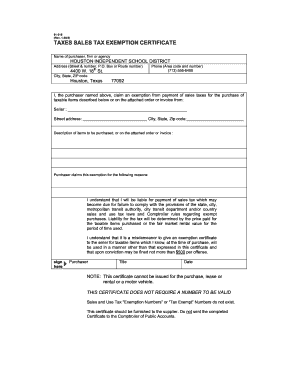

Texas Tax Exempt Form Fill Out And Sign Printable Pdf Template Signnow

Texas Estate Tax Everything You Need To Know Smartasset

Texas Tax Exempt Certificate Fill And Sign Printable Template Online Us Legal Forms

Title Tip Another Legislative Update For Texas Homeowners Candysdirt Com

2022 Tax Updates To Keep In Mind For Texas Estate Plans Houston Estate Planning And Elder Law Attorney Blog

Texas Homestead Tax Exemption Cedar Park Texas Living

Tx Comptroller 01 315 1991 2022 Fill Out Tax Template Online Us Legal Forms

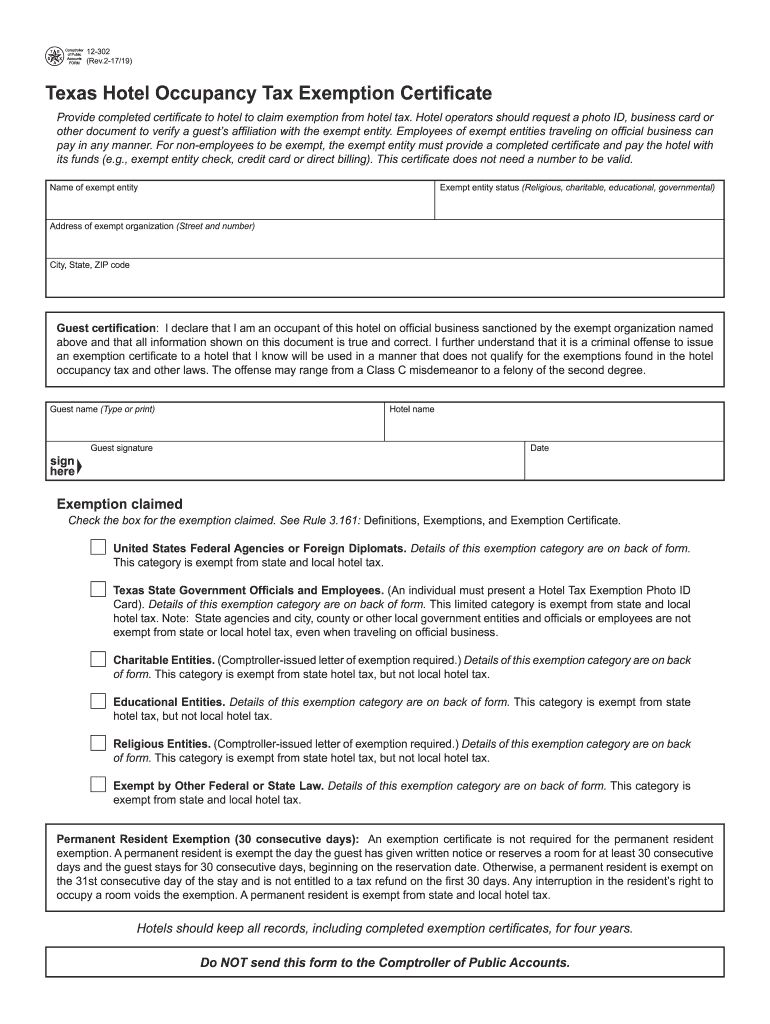

Tx Comptroller 12 302 2017 2022 Fill Out Tax Template Online Us Legal Forms